The trucking industry is currently experiencing a challenging phase due to a weak freight market, which is significantly influencing trailer purchases and asset management strategies. The decrease in freight volumes has created a ripple effect, leading to reduced demand for new trailers and prompting fleets to reassess their operational costs. This context is particularly important for stakeholders in the trucking sector as they navigate the complexities of asset management amidst fluctuating market dynamics.

In this article, we will explore how these market conditions are shaping the behavior of fleet operators and manufacturers, as well as innovative approaches being adopted to optimize assets under current pressures.

As we delve deeper into the current market conditions, it becomes evident that the challenges highlighted in the introduction are not just anecdotal but reflect a broader trend affecting the trucking industry. The ongoing fluctuations in freight volumes are manifesting not only in the immediate financial concerns for fleet operators but also in a significant shift in purchasing strategies and asset management practices.

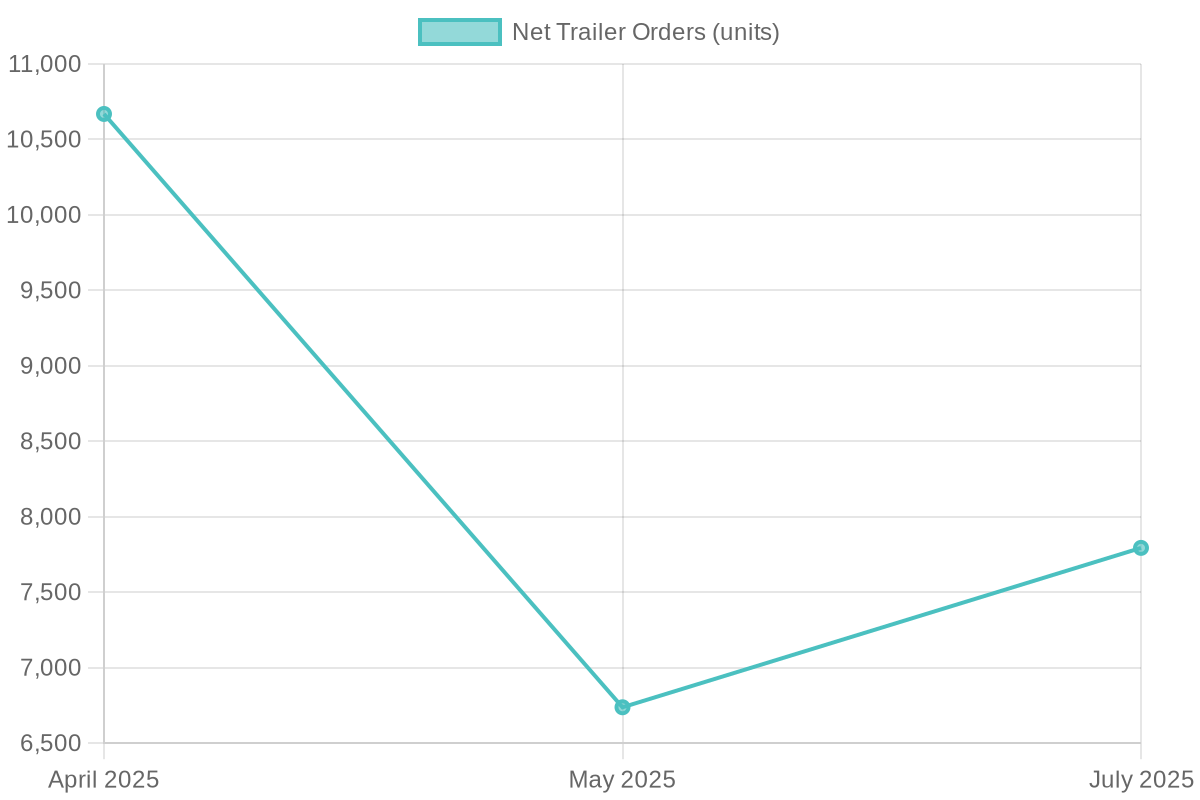

The freight market in 2025 is showing signs of struggle, particularly affecting trailer purchases. Recent statistics reveal a sharp 5% decline in activity overall, with a particularly alarming 39% plunge in July orders compared to June, dropping to just 7,794 units. According to FTR Transportation Intelligence, this decline can largely be attributed to rising tariffs and broader economic uncertainties that have shaken customer confidence. Although July orders were still 23% higher than the same month in 2024, the stark drop from June highlights a volatile market environment.

In the face of these challenges, Dan Moyer, a senior analyst at FTR, pointed to a worrying trend:

“OEMs and suppliers must either absorb margin losses or raise prices, possibly accelerating industry consolidation and favoring larger, vertically integrated players.”

This signal of potential consolidation reflects a lack of faith among smaller stakeholders in the freight market. Many companies are opting to delay new trailer acquisitions and extend the lifespan of their current assets, which has historically negative implications for manufacturers.

Charles Dutil, CEO of Manac, emphasized the cascading effects of this lack of confidence when he stated,

“A fleet with 50 trucks will usually replace 10, 12, or 15 trailers per year. When we enter a period like the one we’re in now, carriers don’t go from 12 to nine or eight trailers — they go from 12 to zero.”

This illustrates the extent to which many fleets have halted their purchasing plans, impacting the broader trailer production landscape as suppliers scramble to adapt to shifting demand patterns.

As fleets prioritize maintaining existing assets over purchasing new trailers, manufacturers face mounting pressure to innovate and find creative solutions to remain competitive. The endurance of these uncertain market conditions will likely depend on how quickly customer confidence can be restored amidst ongoing tariff pressures and evolving economic dynamics.

Detailed Examination of Trailer Production Forecasts

FTR Transportation Intelligence predicts that U.S. trailer production orders will continue to decline. They forecast 187,000 units for 2025, down from the previous year’s order of 230,000, and much lower than 324,000 units in 2023. This trend is concerning and reflects the economic uncertainties and tariff-related challenges impacting the industry.

Here is a simplified overview of the trailer production forecasts:

| Year | Forecasted Units | Percentage Change |

|---|---|---|

| 2023 | 324,000 | – |

| 2024 | 230,000 | -29.0% |

| 2025 | 187,000 | -18.7% |

| 2026 | 204,000 | +9.1% |

| 2027 | 253,000 | +24.0% |

| 2028 | 295,000 | +16.6% |

Implications of FTR’s Forecast on Manufacturers

The anticipated decline in production indicates not just a drop in demand, but also a pressing need for manufacturers to reevaluate their strategies. Rising production costs due to tariffs, such as a 50% tax on imported materials, have squeezed profit margins, prompting manufacturers to adapt or face obsolescence. For instance, in 2025, companies like Paccar expect tariff-related costs to reach around $75 million, impacting their profits and operations [Reuters].

Impact on Fleets

Beyond increasing trailer prices, the economic instability has made fleet operators wary of investing in new assets. Early 2025 saw a steep drop in net trailer orders due to growing uncertainties that discourage customers from making large purchases. Many fleet operators are extending the usage of their current trailers to manage costs during this uncertain period [DC Velocity].

Strategic Responses by Manufacturers

To tackle these challenges, manufacturers may need to adopt several strategic adjustments:

- Diversifying Supply Chains: Finding new sources for materials can help lessen the impacts of tariffs.

- Enhancing Operational Efficiency: Lean manufacturing processes may allow companies to cut costs.

- Adjusting Pricing Strategies: Clear communication about any price increases can help keep customer relations strong, alongside offers of flexible financial solutions.

- Advocacy for Policy Adjustments: Engaging with policymakers to seek changes that reduce tariff impacts can also be beneficial.

Conclusion

The current trends in trailer production highlight significant challenges facing the market, with forecasts reflecting a noticeable decline that requires innovative, flexible strategies from both manufacturers and fleet operators. Their responses to these economic and operational pressures will be crucial for ensuring their long-term viability and competitiveness. Manufacturers must implement creative solutions to navigate through these turbulent times, while fleet operators need to focus on enhancing asset management practices to withstand these fluctuations, and eventually aim for a recovery in the market.

Here is the simplified graph representing the trailer production forecasts:

Key Insights from Recent Analyses

Recent analyses highlight several critical insights for the trucking industry in 2025:

- Production Projections: ACT Research projects a significant decline in U.S. trailer production for 2025, estimating around 182,000 units, reflecting a substantial drop from the previous year.

- Market Challenges: The American Trucking Associations (ATA) foresees minimal growth in freight volumes, alongside increasing compliance costs due to tariffs, impacting operators’ equipment planning.

- Driver Shortage: A persistent shortage of drivers, critical for the industry’s growth and efficiency, is expected to intensify unless effective retention initiatives are implemented.

- Technological Advancements: The introduction and operation of autonomous trucks signify a new era for the industry, presenting both opportunities and challenges.

These developments underscore the dynamic and uncertain landscape in which the trucking industry operates, creating a need for ongoing adaptation and innovation.

The Impact of Tariffs on Trailer Prices and Fleet Operations

The imposition of tariffs on steel and aluminum has significantly influenced the pricing of van trailers, with cascading effects on fleet operations, trailer acquisitions, and broader freight market dynamics.

Impact on Van Trailer Prices

The 25% tariffs on imported steel and aluminum have led to increased production costs for van trailers, as these materials are fundamental to their construction. Manufacturers have reported substantial hikes in material costs, with steel prices rising by approximately 30% over the past year. Consequently, the cost of van trailers has escalated, with some estimates indicating price increases between 16% and 28% (pockettacotruck.com).

Additional data shows that prices for dry van and refrigerated trailers have increased by 16-18% (plmfleet.com), making it clear that tariffs are a significant factor in rising costs.

Notably, the 50% tariffs on imported steel and aluminum have imposed further financial pressure on manufacturers. Dan Moyer, senior analyst at FTR, noted the impact of these tariffs, stating they significantly increase production costs for OEMs/suppliers, which puts downside pressure on the demand for trailers (trucknews.com).

Effects on Fleet Operations and Trailer Acquisitions

The surge in trailer prices has prompted fleet operators to reassess their procurement strategies. Many are extending the service life of existing trailers through enhanced maintenance programs to defer new acquisitions (pockettacotruck.com). This shift is evident in the decline of trailer orders; for instance, July orders dropped by 39% month-over-month (trailer-bodybuilders.com). According to Moyer, trailer orders plummeted to just 6,738 units in May 2025, with cancellations surging to 37.6%, the highest rate in a year (trucknews.com).

Broader Freight Market Dynamics

The increased costs associated with trailers and other equipment have broader implications for the freight market. Higher operational expenses may lead to elevated freight rates as companies pass on costs to consumers. Additionally, the tariffs have introduced volatility into the market, with potential for industry consolidation as smaller operators struggle to absorb the increased costs (trailer-bodybuilders.com). The uncertainty surrounding trade policies further complicates long-term planning for fleet expansions and equipment investments.

In summary, the steel and aluminum tariffs have led to higher van trailer prices, prompting fleet operators to adjust their acquisition and maintenance strategies. These changes are contributing to shifts in the freight market, including potential rate increases and industry consolidation. As noted by the Perryman Group, a sustained 25% tariff could have a significant negative economic impact, potentially leading to an annual loss of $7.6 billion in gross product and the loss of nearly 80,000 jobs in the U.S. economy (perrymangroup.com).

Conclusion

The freight market’s current fluctuations have substantially reshaped trailer management strategies for both manufacturers and fleet operators. With a notable decline in freight volumes, trailer purchases have sharply decreased, as evidenced by recent statistics indicating a drastic drop in orders. The FTR projections for trailer production underscore this trend, forecasting lower production numbers over the coming years, which presents a stark contrast to the booming demand seen just a couple of years ago.

Additionally, the influence of tariffs on steel and aluminum has only exacerbated the situation, inflating trailer prices and compelling fleets to prioritize the maintenance of existing assets rather than investing in new purchases. As noted in the insights shared by industry experts, such shifts in fleet strategies signal a deeper caution and re-evaluation of operational costs amid economic uncertainties.

In this challenging landscape, manufacturers are prompted to adopt innovative strategies to navigate these market dynamics effectively. Diversifying supply chains, enhancing operational efficiencies, and adjusting pricing strategies are critical steps that can help manufacturers maintain competitiveness. Likewise, fleet operators must continue to seek effective asset management practices to ride out these fluctuations while aiming for eventual market recovery and restored customer confidence.

In summary, the interplay of declining freight volumes and escalated costs due to tariffs has led to a precarious situation, demanding agile responses that prioritize strategic foresight and operational adaptability to thrive in an evolving industry.

Increasing Adoption of Innovative Asset Management Solutions

In response to ongoing challenges in the freight market, fleet operators are turning to innovative asset management solutions to enhance efficiency, reduce costs, and improve safety. Recent research highlights notable trends in fleet technology adoption:

Telematics and GPS Tracking

- By 2025, it is anticipated that about 75% of fleet managers will embrace telematics-based fleet management systems, reflecting a significant shift towards technology-driven operations.

- Currently, over 80% of fleet management businesses utilize GPS tracking technology to monitor vehicle locations and statuses, ensuring better visibility and control over assets.

Artificial Intelligence Integration

- The adoption of AI technologies in commercial transportation is gaining momentum, driven largely by safety considerations. Nearly 56% of vendors have already implemented these technologies, with an additional 40% planning to do so within the next year.

- AI-driven predictive maintenance has resulted in a 22% reduction in unscheduled downtime, showcasing the effectiveness of these innovations in minimizing operational disruptions.

Cloud-Based Solutions

- The trend towards cloud-based fleet management solutions has become increasingly prevalent, achieving an adoption rate exceeding 60% globally. This shift has enabled fleets to access real-time data and improve their management capabilities.

- As of 2024, the cloud-based segment captured 68.7% of the market share for fleet management software, demonstrating its growing importance in the industry.

Operational Efficiency and Cost Reduction

- Fleet management companies report an annual return on investment (ROI) between 15% and 20% from the implementation of telematics solutions, indicating strong financial benefits from investing in technology.

- Efficiency gains are also evident, with fleets achieving up to 25% improvement in route efficiency and similar reductions in maintenance costs through the application of predictive analytics.

Enhanced Safety Measures

- The integration of AI-powered telematics has improved driver safety ratings by 25%, underscoring the role of technology in fostering safer fleet operations.

- Currently, nearly 60% of fleet vehicles have driver safety monitoring systems installed, marking a significant move towards prioritizing safety as a core operational aspect.

These statistics clearly illustrate the determination within the trucking industry to leverage technological advancements in their asset management strategies. By addressing market challenges through innovation, fleets aim to enhance competitiveness and navigate the unpredictable landscape of freight demand.

Enhancing Sections 3 and 4 with Related Keywords

In order to optimize the content for SEO and improve discoverability, the following related keywords will be integrated into sections 3 and 4:

- Current Market Conditions (Section 3): Incorporate terms such as asset management strategies and freight pricing trends to highlight the strategic approaches fleets are adopting in response to market fluctuations.

- Trailer Production Forecasts (Section 4): Use phrases like impact of freight pricing trends on production decisions to discuss how shifts in pricing influence manufacturers’ strategies regarding asset management.

Current Market Conditions

As we delve deeper into the current market conditions, it becomes evident that the challenges highlighted in the introduction are not just anecdotal but reflect a broader trend affecting the trucking industry. The ongoing fluctuations in freight volumes are manifesting not only in the immediate financial concerns for fleet operators but also in significant shifts in purchasing strategies and asset management practices. In this context, asset management strategies have become critical for fleets as they navigate rising operational costs alongside fluctuating freight pricing trends.

The freight market in 2025 is showing signs of struggle, particularly affecting trailer purchases. Recent statistics reveal a sharp 5 percent decline in activity overall, with a particularly alarming 39 percent plunge in July orders compared to June, dropping to just 7,794 units. According to FTR Transportation Intelligence, this decline can largely be attributed to rising tariffs and broader economic uncertainties that have shaken customer confidence.

Trailer Production Forecasts

FTR Transportation Intelligence predicts that U.S. trailer production orders will continue to decline, reflecting the direct influence of freight pricing trends on production strategies. They forecast 187,000 units for 2025, down from the previous year’s order of 230,000, and much lower than 324,000 units in 2023. This trend is concerning and reflects the economic uncertainties that impact asset management strategies within the industry.

By incorporating these related keywords, we align the content with search behaviors and trends in the industry, enhancing the article’s visibility and relevance.