Building partnerships with customers is key, and adding value is also important. – Vince Tarola

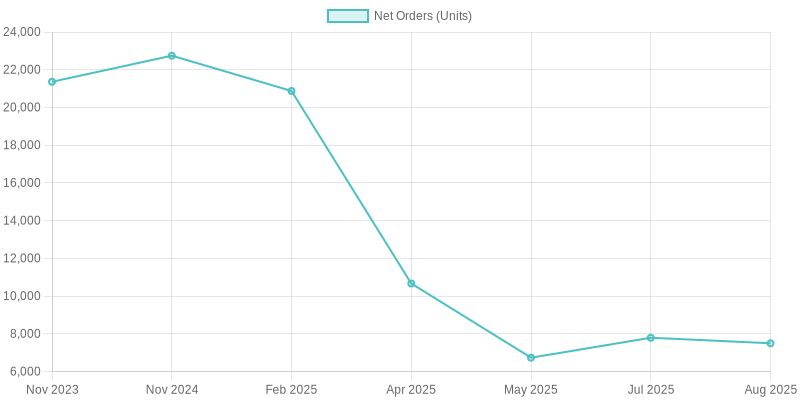

The trailer market is currently navigating a labyrinth of challenges that are reshaping its landscape. With weak freight demand putting a significant strain on the industry, fleet managers face unprecedented hurdles not just in acquiring new trailers but also in managing parts supply and replacement strategies. As order activity declines, notably with a striking 39% drop in July alone, the implications ripple across various facets of the market.

The inflation of trailer prices, exacerbated by post-COVID repercussions, combined with high interest rates and unfavorable exchange rates, adds layers of complexity. This precarious situation requires fleet managers to exercise caution, as their decisions on equipment replacement must adapt to an evolving and uncertain environment.

The delicate balance between operational needs and financial prudence has never been more crucial, demanding a strategic approach to navigating these turbulent waters.

Understanding the Current Trailer Market Landscape

The current state of the trailer market presents a challenging landscape for fleet managers and manufacturers alike. Recent reports highlight a worrying trend, with trailer order activity experiencing a 5% decline year-to-date. Moreover, July orders notably plummeted by 39%, returning to levels that reflect heightened market pressures. The total net trailer orders for July dropped to only 7,794 units, a drastic fall from previous months and indicative of the turbulence affecting the industry.

FTR Transportation Intelligence anticipates that total trailer production orders for the year will reach just 187,000 units, down from 230,000 last year. This forecast underscores the severity of the current market conditions that are influencing purchasing behaviors and strategies within fleet management.

Several key factors contribute to these trends:

- Tariff Pressures: Rising tariffs on key raw materials have escalated production costs, causing manufacturers to either absorb these costs or transfer them to customers. This situation compels fleet managers to reconsider their purchase timelines, opting to delay new acquisitions until conditions improve.

- Market Uncertainty: The ongoing volatility in the freight market has forced many fleets to extend their equipment replacement cycles. Instead of investing in new trailers, fleet operators are increasingly relying on used equipment, which in turn affects the demand for new trailer production. This shift in strategy reflects a cautious approach as managers calculate the long-term viability of their assets.

- Financial Strain: With high inflation and increased interest rates, the financial landscape is becoming less favorable. Fleet managers are now more inclined to weigh the cost-benefit of each purchase meticulously, often leading to decisions that prioritize maintenance of existing inventory over new investments.

The cumulative effect of these statistical trends reveals a pivotal transformation in fleet management strategies. In such a landscape, fleet operators are adopting a more conservative approach—prioritizing maintenance and strategic long-term planning while navigating an uncertain economic environment. As they look ahead, managing efficiency and cost-effectiveness will be fundamental to thrive amid these challenges.

Ultimately, understanding the intricate dynamics of the trailer market will be essential for fleet managers as they prepare to make informed decisions in the months and years to come.

The Importance of Equipment Age in Replacement Strategies

The age of equipment within a fleet plays a crucial role in determining the effectiveness of replacement strategies. As fleet managers seek to optimize their operations amid economic uncertainty, understanding when to retire aging trailers becomes paramount. Industry experts emphasize that a trailer’s age directly correlates with its maintenance demands, operational efficiency, and ultimately, its replacement timeline.

Dan Moyer highlights, “Aging equipment often necessitates increased maintenance costs and downtime. As trailers age, they require more frequent repairs, which may lead to diminished reliability.”

This perspective illustrates the financial implications of maintaining older fleet vehicles, compelling managers to reconsider their approach to equipment replacement.

Charles Dutil discusses this further by stating, “We need to recognize that each fleet may have different thresholds for replacement. While some operators might extend the life of their trailers, others may find that doing so is cost-prohibitive in the long run.”

This quote underscores the importance of tailor-made strategies, as each fleet must evaluate its unique circumstances when deciding how long to keep their trailers on the road.

Meanwhile, Jason Hirsch points out that “Clean equipment always sells,” emphasizing that the resale value of a trailer decreases with age and wear and tear.

This assertion highlights the potential long-term benefits of replacing trailers before they reach a critical age, aligning with a proactive trailer replacement strategy that can maximize resale value and minimize unscheduled downtime.

In summary, understanding the significance of equipment age influences fleet managers’ decisions regarding maintenance and replacement in the context of cost-effective fleet management. With expert insights on the matter, it becomes clear that the age of trailers is not just a number; it is a key factor in determining the sustainability and profitability of fleet operations. As managers navigate today’s challenging market conditions, staying proactive about trailer age will be instrumental in developing effective replacement strategies.

In the wake of post-COVID inflation, fleet managers are encountering substantial challenges due to soaring trailer prices, which have risen by 16% to 28% because of increased material costs. This inflationary trend is influencing purchasing decisions significantly, as many fleet operators are now adopting more strategic approaches to equipment replacement.

Key Insights:

- Extended Equipment Lifecycles: Many fleet managers are opting to prolong the service life of their current trailers instead of purchasing new ones. This strategy involves intensifying preventive maintenance practices to ensure that older trailers remain operational and efficient.

- Refurbishment of Existing Trailers: Rather than face the high costs of new units, fleet managers are increasingly choosing to refurbish their existing trailers. This option can range from $10,000 to $15,000 per trailer, which is significantly cheaper than acquiring new ones.

- Supplier Diversification: To maintain supply chain resilience, fleet managers are diversifying their supplier base. Establishing relationships with multiple suppliers can alleviate the pressure caused by shortages and rising costs.

- Predictive Maintenance Implementation: The adoption of telematics and predictive maintenance systems is becoming a crucial part of fleet strategy. These systems enable firms to foresee maintenance needs, thus minimizing the risk of unexpected breakdowns and optimizing replacement schedules.

- Advanced Planning and Early Ordering: Fleet managers are placing orders for new equipment well in advance to secure prices and manage inventory more effectively amidst fluctuating market conditions.

In light of these inflationary pressures, fleet managers must navigate the balance between operational needs and financial prudence. They are increasingly tasked with making informed decisions that not only meet immediate demands but also ensure long-term sustainability and efficiency in their fleets. As such, a strategic approach to equipment replacement is more essential than ever in today’s complex market environment.

Adapting to Market Realities: Strategies for Fleet Managers

Given the weak freight demand and rising trailer prices, fleet managers must take proactive steps to navigate these challenges. Here are some practical strategies to consider:

- Optimize Fleet Size: Many carriers are downsizing their fleets to match the current market conditions. Heartland Express has eliminated underperforming services, and Marten Transport has cut down its number of tractors. This not only makes better use of drivers but also reduces operational costs, helping fleets manage lower freight volumes.

- Extend Trailer Lifespan: With trailer prices rising by 16% to 28% due to tariffs and inflation, many fleets are conserving capital by delaying new purchases and focusing on maintaining their current equipment. Refurbishing older trailers is becoming more common rather than buying new ones.

- Implement Preventive Maintenance: Fleet managers should emphasize preventive maintenance to minimize unexpected repairs and extend the lifespan of their trailers. Using telematics can help track vehicle health and maintenance needs, allowing managers to address problems early before they cause breakdowns.

- Leverage Technology for Efficiency: Utilizing data analysis and telematics not only streamlines routes but also helps cut fuel costs. This technology enables fleet managers to monitor the performance of their vehicles and ensure they are well-maintained, enhancing overall efficiency.

- Explore Alternative Financing Options: With high equipment costs, fleets are often looking to leasing options to keep operations going without massive upfront investments. This helps maintain cash flow during uncertain times.

- Enhance Load Optimization: Smart load planning can maximize trailer use, reducing the number of trips needed, lowering fuel costs, and boosting profitability. Carriers can benefit from collaborating with others for co-loading opportunities.

By putting these strategies into practice, fleet managers can better navigate market challenges and prepare for recovery when conditions improve. It’s essential for each fleet to tailor its approach to its specific needs.

| Factor | Older Trailers | Newer Trailers |

|---|---|---|

| Maintenance Costs | Costs increase as trailers age, potentially exceeding 30-40% of trailer value for those over 10 years old. Annual expenses can average significantly higher, affecting overall fleet budgets. Source | Typically lower in the initial years, averaging around $500 annually. Maintenance costs increase after an initial period but remain steady in the early maintenance lifecycle. Source |

| Resale Value | Depreciates slowly after initial years, maintaining a higher resale value if well-maintained. A well-maintained high-quality trailer can retain a resale value of around $40,000 after 5 years from a $50,000 purchase. Source | Depreciates approximately 20-30% in the first few years, then stabilizes in value. A faster depreciation can lead to greater losses if not managed effectively. Source |

| Performance | Typically lacks advanced tech features and may be less fuel-efficient. Older trailers can average heavier and have reduced payload capabilities compared to newer models. | Incorporates modern technologies, enhancing operational efficiency. Average weight reduction of 600 to 700 lbs. in new models improves fuel efficiency and payload capacity. Source |

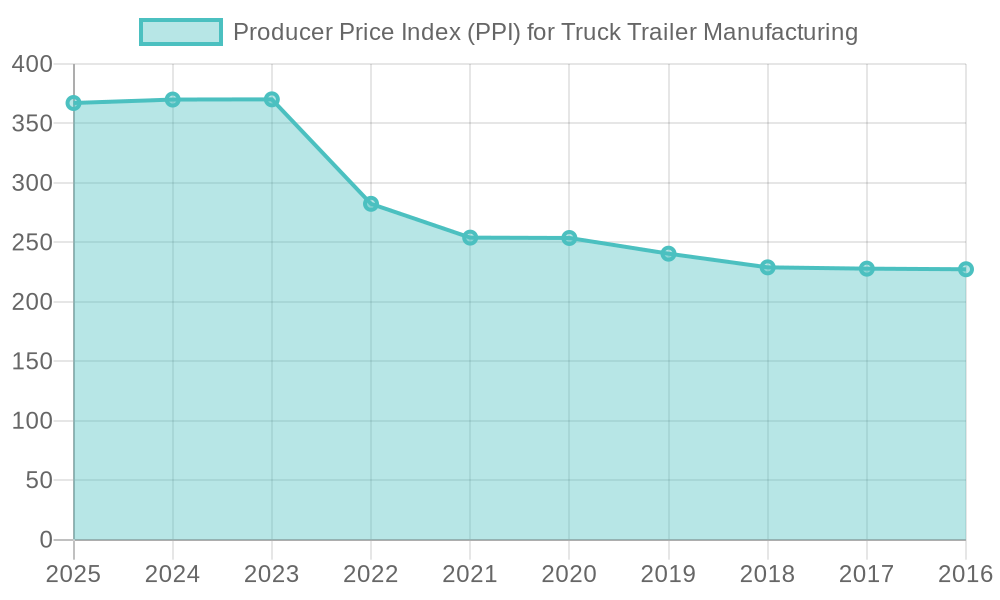

Graph depicting the Producer Price Index (PPI) for Truck Trailer Manufacturing over the years, highlighting peaks and troughs influenced by economic factors like inflation and tariffs.

Conclusion

In light of the significant fluctuations currently affecting the trailer market, fleet managers must prioritize actionable strategies to effectively navigate this challenging landscape. Here are key steps to consider:

- Implement Preventive Maintenance: Keep your existing trailers operational and minimize costs by emphasizing preventive maintenance practices that can extend their lifecycle.

- Reassess Purchasing Strategies: Evaluate your current approach to acquiring new equipment. Consider early procurement planning and flexible acquisition models to optimize your budget in the face of rising costs.

- Leverage Technology and Data: Utilize telematics and data analysis to monitor vehicle performance, identify maintenance trends, and make informed decisions that align with both immediate needs and long-term sustainability.

- Diversify Supplier Relationships: Building relationships with multiple suppliers can enhance your supply chain’s resilience and help mitigate costs associated with shortages or price increases.

- Reflect and Adapt: Fleet managers are urged to conduct a comprehensive review of their operations, identifying opportunities for improvement, efficiency, and responsiveness to market changes.

As the trailer market continues to navigate uncertainty, strategic foresight and proactive management will be essential for fleets to emerge stronger from these adversities. By focusing on these actionable strategies, fleet managers can better secure the health of their operations and set themselves up for future success.

Expert Opinions

Charles Dutil

Profile: A respected figure in the trucking industry, Charles Dutil specializes in fleet management and replacement strategies. With years of experience, he emphasizes the importance of tailored approaches for each fleet’s unique needs.

“A fleet with 50 trucks will usually replace 10, 12, or 15 trailers per year… they simply decide not to replace a single trailer.”

John Foss

Profile: An expert in trailer production and market pricing, John Foss provides critical insights into the dynamics affecting the trailer market. His analysis serves as a guide for fleet managers navigating challenging cost environments.

“I think this could be the new reality on what trailers cost right now.”

Jason Hirsch

Profile: Known for his expertise in equipment maintenance and resale value, Jason Hirsch advises fleet operators on maximizing the lifespan and profitability of their trailers.

“Clean equipment always sells.”

These expert opinions serve as valuable insights, helping fleet managers and industry stakeholders navigate the complexities of today’s challenging market conditions.

Fleet Managers’ Summary Checklist

-

Understanding Equipment Aging

- Recognize that aging trailers lead to increased maintenance costs and risks.

- Decision-making on replacement should consider each fleet’s unique circumstances.

- Monitor trailer age closely to maximize resale value before reaching critical maintenance stages.

-

Purchasing Strategies in a Weak Market

- Be prepared for fluctuating prices; trailer prices have surged between 16% to 28% due to inflation.

- Explore refurbishment options for existing trailers to save costs compared to new purchases.

- Diversify supplier relationships to ensure a resilient supply chain amid shortages.

- Prioritize advanced planning and early ordering of equipment to lock in prices and manage inventory efficiently.

-

Adapting to Market Challenges

- Downsize fleets appropriately to align with weak freight demand and improve driver utilization.

- Emphasize preventive maintenance to extend the lifespan of existing trailers and minimize unexpected repairs.

- Leverage technology and telematics for data-driven decisions, optimizing routes and vehicle performance.

- Explore alternative financing solutions like leasing to keep operations flexible without heavy capital expenditure.

By adhering to this checklist, fleet managers can navigate the complexities of today’s trailer market while ensuring operational efficiency and cost-effectiveness.

Visual representation showing key market trend data related to the trailer market, including statistics on order activity, price fluctuations, and economic impacts on fleet management decisions.

Graph illustrating trends in U.S. trailer production orders, highlighting changes during economic downturns and the influence of inflation and supply chain issues.

Purchasing Strategies

- Decline in Trailer Orders: Recent data from the American Trucking Association highlights a year-over-year decline in trailer sales by 6.83% in the first quarter of 2025, which corresponds with our claim of weak purchase activity and emphasizes ongoing market pressures. Source

- Inflation Impact: As per FTR Transportation Intelligence, the inflation of trailer prices due to tariffs has escalated production costs, with a notable 100% tariff on certain imports from China implemented in late 2025 affecting raw materials. This supports the statement on rising operational costs faced by fleet managers. Source

- Simply put, Higher Interest Rates: Data collected indicates that fleet managers are increasingly adopting more strategic approaches to equipment replacement in response to heightened inflation of 16% to 28% on trailer prices, confirming the need for calculated purchasing strategies. Source

- Technological Advancement in Fleet Management: Fleet managers are now leveraging IoT technologies and telematics for operational efficiency, as stated by GlobeNewswire, showing an alignment with our discussion on evolving strategies due to external pressures. Source

- Market Uncertainty and Strategy Adaptation: In reaction to trade tensions and market uncertainties, fleets are re-evaluating their equipment replacement cycles. The strategic shift to modular trailer designs and refurbishment strategies reflects a proactive response to the prevailing economic climate, as detailed by sources like Truck News. Source