In the competitive landscape of trucking, operational efficiency is paramount for fleet managers and company owners. A & R Truck Repair Abbotsford stands at the forefront, delivering specialized on-site repair services that cater to the unique needs of the trucking industry. This article explores the diverse offerings of A & R Truck Repair, emphasizing their economic impact in Abbotsford, the technological innovations they employ to enhance service delivery, and how customer satisfaction drives their operations. As we delve into each chapter, a comprehensive understanding of A & R Truck Repair’s value will unfold, showcasing their commitment to keeping trucks operational and ensuring industry stakeholders can focus on growth without interruption.

On the Move: How A & R Mobile Truck Repair Keeps Abbotsford’s Fleets Rolling

Abbotsford sits at a critical crossroads of regional commerce in British Columbia, where weather, road networks, and freight demand converge to form a bustling logistics pulse. In a landscape where every minute of downtime can ripple through a fleet’s schedule, the ability to get a truck back on the road quickly becomes a competitive edge. It is within this environment that A & R Mobile Truck Repair operates as more than a service provider; they function as a mobility partner for general freight operators and local trucking interests alike. The essence of their work rests on a simple but powerful premise: bring skilled hands, diagnostic insight, and ready-to-deploy parts to the customer, not the other way around. The mobile model is not a convenience so much as a practical necessity in a region where rough weather, remote yards, and tight delivery windows create friction in the path from dock to destination. By meeting customers where they are, the company minimizes the friction of downtime and helps fleets stay aligned with their commitments to clients, suppliers, and, ultimately, their own bottom lines.

The on-site approach defines the core value proposition here. Technicians roll to a truck’s location with a toolbox designed for field work, capable of diagnosing issues on the spot and performing a wide spectrum of repairs in the field. The objective is to restore mobility with as few trips to a fixed shop as possible. This model naturally dovetails with the realities of Abbotsford’s diverse trucking landscape, where vehicles service a broad array of routes—from intra-city deliveries to longer runs into the valley and beyond. When a tractor breaks down near a warehouse, on a delivery run, or at a client site, the difference between a lost shift and a completed schedule can be a few hours, or even less, with the right mobile response.

The breadth of services offered underscores the practical, all-in-one nature of mobile repair. Engine repairs address the heart of a performance problem—whether it manifests as rough running, excessive fuel use, or warning lights that insist on attention. Transmission servicing protects the smooth transfer of power that keeps heavy loads moving without drama. Brake system maintenance is not merely a compliance issue; it is a core safety discipline that fleets cannot afford to ignore. Electrical diagnostics, once the domain of fixed shops, are increasingly essential in modern heavy-duty and medium-duty vehicles, where sensors, controllers, and harnesses interact with telematics, lighting, and safety systems. Preventative maintenance rounds out the portfolio, acting as a forward-looking safeguard against unexpected failures. Collectively, these services form a continuum: a field service capability that protects uptime, reduces towing costs, and preserves the operational rhythm that keeps goods flowing through Abbotsford’s supply chains.

What makes the offering credible in the field is not only the range of tasks but the expertise behind them. The mechanics who operate in this space are trained to handle a variety of makes and models, a practical necessity when fleets mix equipment from different manufacturers or work with aging units that require more nuanced care. In the field, decisions must be made quickly, accurately, and with an eye toward reliability. A well-equipped mobile setup enables technicians to perform everything from minor adjustments to more involved overhauls, often using portable diagnostic tools that can read engine codes, transmission data, and electrical system status in real time. The ability to interpret these signals at a customer location saves time and helps fleet managers maintain a clear sense of what is needed and what to expect next in the repair process.

Behind the scenes, the reasoning for choosing a mobile provider in Abbotsford rests on a series of practical advantages that align with how fleets operate today. First, there is the obvious benefit of reduced downtime. In trucking, time is money, and every hour a vehicle is out of service translates into potential missed deliveries or rescheduled routes. By meeting the truck at its location, the service eliminates additional transit and the risk of a broken chain of custody that can complicate logistics. Second, there is the advantage of real-time assessment and communication. Technicians report their findings on-site, often sharing an initial diagnostic readout with the fleet manager and discussing a plan of action that prioritizes safety and reliability. This transparency builds trust and sets the stage for ongoing maintenance collaboration rather than a one-off fix.

A further layer of value comes from the compact, purpose-built nature of field operations. The mobile team can consolidate many common repairs into single visits, provided the required parts are on hand or can be sourced quickly. This capability is particularly important in Abbotsford, where vehicles serve multiple clients, sit at varying yards, and frequently operate under pressure to meet tight schedules. The use of portable shops and on-board diagnostic equipment means that even complex tasks—such as diagnosing intermittent electrical faults or addressing transmission concerns that aren’t easily reproducible in a fixed shop—can be pursued with disciplined rigor. The result is a maintenance cycle that respects the realities of the road and the job, not one that forces fleets to fit their needs into the schedule of a distant repair facility.

The values that guide the company—professionalism, honesty, and competitive pricing—are not mere marketing lines. They shape every interaction on a job site and contribute to a reputation that grows through word of mouth and repeated business. Fleet managers learn to expect clear pricing, transparent timelines, and work that prioritizes safety and durability as much as speed. The emphasis on honesty is especially important in a field where the line between “repair now” and “repair later” can be thin. When a field mechanic explains why a fix should be scheduled within a maintenance window or why a certain part should be replaced sooner rather than later, the choice supports reliability and cost control over short-term convenience. That is the essence of a trustworthy partner in a business ecosystem where downtime carries measurable consequences for service levels and client relationships.

In speaking about the practicalities of service delivery, it is worth noting the implications for employment and workforce development. The local staffing picture often includes roles such as mechanics, assistant technicians, and skilled tradespeople who contribute to the on-site repair capability. The ability to attract and retain qualified personnel who can operate in a mobile setting—where travel between sites, variable conditions, and the need for rapid decision-making are the norm—speaks to the professional culture of the operation. Competitive wages, opportunities for skills development, and a pathway to broader responsibilities create an environment where technicians are motivated to deliver consistent, high-quality work, even under pressure. In a sector that increasingly relies on technicians who can adapt to the changing landscape of fleet technology, this kind of investment in people helps ensure that mobile repair can remain responsive and effective over time.

From a fleet-management perspective, the decision to partner with a mobile repair provider extends beyond the individual job. It signals a shift toward more proactive maintenance strategies—where the emphasis is on preventing failures before they disrupt operations and on coordinating service in ways that minimize risk to schedules and customers. The preventative maintenance component, in particular, plays a critical role. Regular screenings of engine health, transmission performance, braking systems, and electrical integrity help identify trends, anticipate parts wear, and plan interventions in a way that aligns with a fleet’s operational calendar. When combined with the on-site capability to implement fixes quickly, these preventive measures reduce the probability of emergency calls and the associated disruption, which can cascade into slower deliveries or lost business opportunities. The approach is not merely reactive repair but a holistic service philosophy that helps Abbotsford’s trucking community preserve reliability in a market where demand for timely transportation continues to grow.

The practical consequences for customers extend into cost planning and budgeting as well. Fleet managers who work with an on-site repair partner often benefit from more predictable maintenance expenditures. Costs can be allocated by location, by vehicle class, or by maintenance category, which in turn supports more accurate forecasting and resource allocation. To some readers, this may seem like a sidebar concern, but for a growing operation in a competitive environment, the ability to anticipate and manage maintenance expenses is a strategic asset. In this respect, a trusted mobile partner does more than fix vehicles; it helps engineering and operations teams align their capital and operating budgets with a clear view of the road ahead. This alignment often translates into better inventory control, fewer capital expenditures on unexpected major repairs, and a smoother cash flow that keeps the wheels turning even when market volatility or weather challenges press in.

Readers who want a practical reference on how to think about maintenance costs in a mobile-repair framework can explore a resource that focuses on budgeting for routine truck maintenance. The guidance there complements the on-site repair model by offering a framework fleets can adapt to their own needs—planning, prioritizing, and paying for preventive work in ways that protect uptime and extend asset life. This resource is presented in a way that makes it easier for fleet managers to translate insights into the real world of Abbotsford’s operations, where weather, geography, and the cadence of shipments all shape maintenance decisions. For readers seeking a ready-made bridge between planning and action, this linked guide provides a concise, actionable path toward integrating routine maintenance into a broader fleet-management strategy. Budgeting for Routine Truck Maintenance.

Alongside the technical and financial considerations, there is a human dimension to the work. The technicians who serve Abbotsford’s streets bring not only wrench power but also a mindset rooted in service: they show up with punctuality, communicate clearly, and treat customer sites with respect for the work being done and the space around it. A partner that prioritizes safety and transparency earns trust; trust, in turn, becomes the lead indicator of long-term reliability. When fleets experience a mobile repair visit that resolves a fault and clears a service pathway with minimal disruption, the impact resonates in the form of fewer headaches, smoother operations, and a greater sense of predictability in daily plans. That is the quiet strength of mobile truck repair in a place like Abbotsford, where logistics teams must coordinate a chain of events across yards, highways, and delivery windows, all while maintaining safety, compliance, and efficiency.

The likelihood of public recognition also matters in shaping the reputation of a mobile repair service. In a sector where customer feedback is a valuable signal, the presence of external profiles that document performance and reliability—such as a listing on a reputable directory—helps reassure prospective clients that the service lives up to its claims. For readers curious about the community footprint of the Abbotsford operation, a profile in an external directory confirms the company’s established presence and its role within the local economy. While the specifics of any single review can vary, the overall pattern of promptness, reliability, and professional conduct tends to hold across experiences, reinforcing the idea that mobile repair is not a bypass around quality control but a concentrated form of it applied where fleets operate.

Ultimately, the chapter of Abbotsford’s trucking story that A & R Mobile Truck Repair helps write is one of continuity and momentum. The service model recognizes that trucks do not stop when adventure or weather dictates; they require a practical, efficient, and trustworthy response that can travel to them. In a region where freight movement is a lifeline, the ability to shorten repair cycles and stabilize schedules matters as much as the repairs themselves. The company’s emphasis on skilled field work, a broad repair portfolio, and a customer-first ethos aligns with the needs of a vibrant local economy that relies on reliable hauls and timely deliveries. The result is not merely a set of services but a working framework in which the road, the workshop, and the customer’s logistics plan converge—an integrated system designed to keep Abbotsford’s fleets rolling.

As with any long-term partnership, the question of reliability and consistency continues to surface in discussions about mobile repair. Fleet managers who have learned to rely on this model often talk about the quiet confidence that comes from knowing a trusted technician will arrive on time, diagnose with clarity, and implement a fix with minimal intrusion into daily operations. That confidence is earned, not assumed, through a track record of responsibility, transparency, and measurable improvements in uptime. In the broader arc of Abbotsford’s transportation network, the evolution toward mobile, on-site maintenance represents a pragmatic answer to the demands of modern logistics—a world where the clock governs performance and where keeping pace with customer needs means keeping wheels turning, one well-timed repair at a time. The story of A & R Mobile Truck Repair sits at the heart of that evolution, a clear example of how mobile expertise can transform a city’s freight ecosystem by delivering speed, reliability, and substantial value to fleets that keep goods moving through the region.

External resource: https://www.mapquest.com/business/abbotsford-bc/a-r-mobile-truck-repair-1729549

Keeping Fleets Moving: The Economic Role of A & R Mobile Truck Repair in Abbotsford’s Trucking Network

A & R Mobile Truck Repair has a practical influence that extends beyond individual breakdowns. By bringing technicians to trucks wherever they are, the company reduces lost hours, lowers recovery costs, and stabilizes local freight operations. That direct service removes layers of friction from the supply chain. It also changes how small and medium carriers plan maintenance, budget for repairs, and manage customer commitments.

When a truck goes out of service, costs ripple quickly. A single disabled vehicle can mean missed pickups, delayed deliveries, driver idle time, and unexpected towing bills. For carriers operating under tight schedules, those losses add up fast. Mobile repair eliminates many of those expenses by fixing issues on-site. The economic effect is simple and measurable: less downtime equals more productive miles. For local carriers, that translates into steadier revenues and a stronger ability to meet contract terms.

Those benefits matter most in regions like Abbotsford, where the trucking ecosystem supports agriculture, manufacturing, retail distribution, and cross-border freight. Trucks are the last-mile link that moves raw materials to processing facilities and finished goods to regional markets. When repair response is rapid, inventory flows more predictably. Processors avoid idle lines, retailers keep shelves stocked, and perishable goods move before quality declines. A & R Mobile Truck Repair’s rapid-response capacity reduces the likelihood that a single mechanical failure will escalate into a cascade of production or distribution setbacks.

The company’s role is not just operational. It has economic multiplier effects that support the broader local economy. First, on a micro level, maintaining fleet availability keeps small carriers competitive. Those businesses often operate with tight margins and limited spare equipment. Quick field repairs allow them to honor service windows and retain contracts they might otherwise lose. Second, reliable maintenance supports employment stability across carriers, warehouses, and related vendors. When trucks run reliably, load schedules stay intact and labor demand at terminals remains steady.

On a macro level, local maintenance providers contribute to the resilience of regional logistics. The U.S. automobile and trucking industry contributes hundreds of billions to national GDP, a reminder of how foundational freight movement is to economic function. While Canadian figures differ, the structural truth is similar: dependable vehicle maintenance underpins supply chain reliability. A & R Mobile Truck Repair exemplifies this by helping fleets avoid the indirect costs of breakdowns—lost sales, emergency premium shipping, and reputational damage that can reduce future business.

Operational efficiency from mobile repair also reduces firms’ capital pressures. Fleet owners face continuous decisions about replacing aging units, investing in newer, cleaner models, or stretching the life of current vehicles. When local technicians can keep older trucks roadworthy at reasonable cost, carriers gain flexibility in capital planning. That flexibility enables balanced investment strategies—owners can allocate resources between fleet modernization, driver training, and business development instead of spending disproportionately on emergency repairs and towing.

The company’s skilled technicians form another economic lever. Local technical expertise lowers barriers for smaller carriers to meet maintenance standards. Training and experience in field repairs support knowledge transfer across the industry. Technicians who work on a variety of vehicle models and issues can advise clients on preventive measures and upgrades. This informal advisory role reduces the frequency of major failures. Over time, reduced failure rates shrink the total cost of ownership for fleets operating in the region.

Regulatory changes expected in the medium term increase the value of responsive, knowledgeable repair providers. Policies affecting medium and heavy commercial vehicles will shift compliance requirements, emissions standards, and potentially retrofit timelines. Those changes will intensify demand for technicians familiar with new systems and with retrofit procedures. A & R Mobile Truck Repair’s proximity to local fleets means it can be a frontline partner during transition periods. Rapid, on-site adjustments and guidance help carriers implement compliance measures without significant disruption to operations.

There is also an environmental-economic dimension. Keeping trucks in efficient mechanical condition reduces fuel consumption and emissions per mile. That effect matters as regulators tighten emissions expectations and as companies pursue sustainability goals. Minimizing the downtime associated with breakdowns reduces the incidence of recovery trips and secondary emissions from towing. In aggregate, these improvements support carriers’ efforts to lower operating costs while meeting environmental targets.

The financial stability mobile repair provides is tangible for small fleets. Carriers can avoid spiking short-term costs that erode profitability, such as last-minute rentals or expedited logistics. They can also reduce fluctuating cash flow risk by smoothing maintenance expenditures. Predictable, lower-cost field repairs enable better budgeting. For guidance about planning maintenance costs within a fleet budget, see this resource on budgeting for routine truck maintenance: budgeting for routine truck maintenance.

Beyond direct client benefits, the company’s operations generate local economic activity. Purchasing parts, renting space for administrative tasks, and hiring technicians all create demand for goods and services. Local vendors, from parts suppliers to tire shops, receive ongoing business that sustains jobs. When technicians need specialized parts quickly, local retailers and distributors often fulfill those orders. That creates an interlinked local market for transport maintenance that keeps money circulating within the community.

Emergency response capability adds another layer of economic value. Peak seasons—harvest time, holiday retail surges, and construction booms—create periods where fleet downtime has outsized consequences. Mobile technicians who respond promptly reduce the odds that a single failure will cause a missed seasonal opportunity. For example, agricultural shippers face narrow windows to move perishable produce. On-site repairs that return trucks to service within hours protect growers’ revenue and preserve market relationships.

Insurance and risk management are affected too. Rapid repair can mitigate claims exposure. A quick roadside fix reduces cargo exposure time and the risk of secondary accidents. That can translate into lower claim costs and lower insurance premiums over time. Carriers that demonstrate robust maintenance and rapid response capability may negotiate better terms with insurers, reflecting a reduced operational risk profile.

The presence of a local mobile repair provider also shapes the competitive landscape. Carriers that can guarantee rapid recovery time win more contracts. Clients value reliability highly, particularly in local trucking where flexibility and speed matter. A & R Mobile Truck Repair’s service supports those reliability claims. That capacity enhances the attractiveness of Abbotsford-based carriers to shippers who prefer suppliers they can rely on under tight timelines.

Workforce development is a subtler but crucial effect. The demand for skilled field technicians encourages training, apprenticeships, and on-the-job learning. Technicians develop transferable skills relevant to newer vehicle technologies. That creates a labor pool that benefits the regional industry as it modernizes. Employers can draw on that workforce to implement fleet upgrades and compliance retrofits more smoothly.

A final economic point concerns industrial strategy and resilience. Local economies that maintain essential service capabilities—like mobile truck repair—are less vulnerable to external shocks. During supply chain disturbances, having repair capacity near major freight corridors reduces the risk of prolonged interruptions. For Abbotsford, a city with significant freight activity, such resilience supports investor confidence and local business continuity.

Taken together, these elements form a compact but powerful economic narrative. Mobile repair reduces direct costs, stabilizes revenues, supports employment, and enhances environmental performance. It also smooths capital allocation decisions for carriers and improves the risk profile for insurers. As regulations evolve and fleets modernize, the practical, on-the-ground expertise of mobile technicians will become even more valuable.

This role positions A & R Mobile Truck Repair as more than a service provider. It functions as an operational anchor that permits carriers to remain flexible and competitive. That anchoring effect ripples through Abbotsford’s freight network, supporting continuity for businesses that depend on timely transport. The capacity to restore trucks swiftly keeps cargo moving, workers employed, and local markets supplied. It is a small piece of the logistics puzzle, but a decisive one.

For policymakers and industry planners, the lesson is clear: investments in localized maintenance capacity yield outsized returns in resilience and continuity. Supporting training, ensuring parts availability, and fostering networks between carriers and mobile repair providers can preserve economic momentum. As the sector adapts to regulatory changes and technology updates, local repair expertise will be an essential complement.

Looking ahead, the value chain impact of mobile repair will continue to evolve. As vehicles adopt new technologies and emissions standards tighten, field technicians will shift from routine mechanical fixes to complex system diagnostics and software-enabled interventions. The companies that adapt will sustain local carriers through transitions. That sustained support will remain central to Abbotsford’s role as a reliable node in regional freight movement.

For further detail on the policy changes shaping commercial vehicle repair and fleet management, consult the recent transportation analysis on the 2025 policy transition: https://www.transportation.gov/analysis/2025-policy-transition

How Technology Powers Rapid, Reliable Repairs at A & R Truck Repair Abbotsford

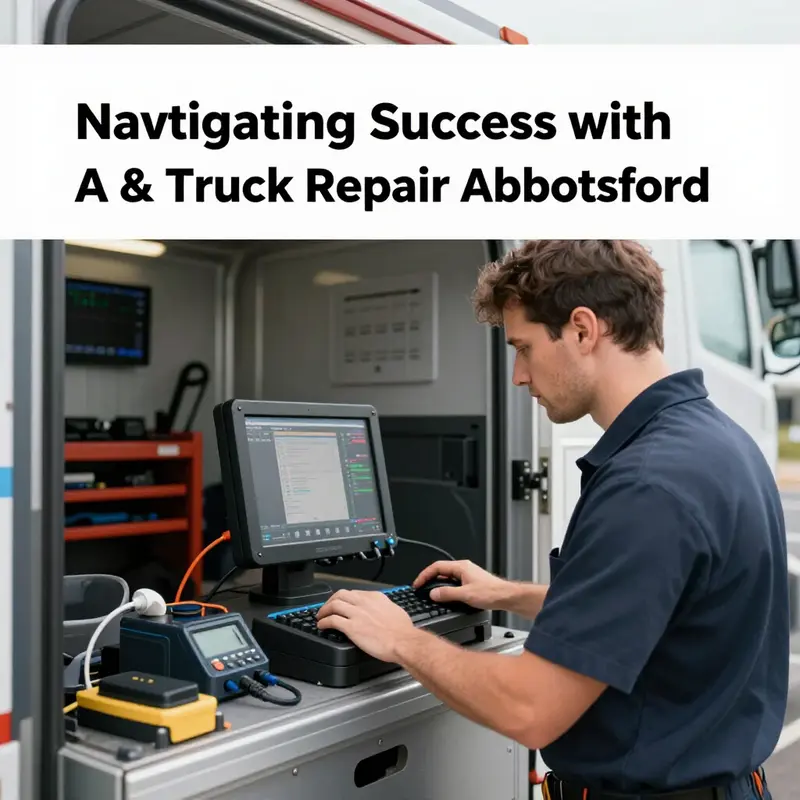

A & R Truck Repair Abbotsford pairs hands-on skill with modern technology to change how local trucking businesses stay on the road. Their approach treats technology not as a novelty, but as a set of practical tools that reduce downtime, improve safety, and sharpen decision-making. Technicians still bring experience and judgment. Technology accelerates what they can do and makes outcomes more predictable. The result keeps freight moving and helps fleets control operating costs.

Advanced diagnostic tools form the backbone of this system. Modern heavy vehicles are full of sensors and control modules. A & R’s technicians connect diagnostic interfaces directly to a truck’s onboard systems. These connections reveal error codes, live sensor readings, and performance logs. That data shortens the time between symptom and solution. A fault that previously required hours of manual testing can now be isolated in a fraction of that time. Rapid diagnosis means repairs begin sooner, and trucks return to service faster.

Beyond speed, diagnostics enable predictive maintenance. When historical data shows a component trending toward failure, the team can recommend service before a breakdown happens. Predictive alerts are especially valuable for engine and transmission systems. Those failures are costly and disruptive. Predictive maintenance reduces roadside calls and unscheduled shop visits. Fleets gain the ability to plan repairs during low-demand windows. Planned maintenance lowers repair costs because technicians address problems early, often avoiding expensive secondary damage.

Digital work order systems tie the diagnostic process to clear, trackable action. Each repair becomes a documented workflow that technicians and customers can follow. Work orders capture the problem description, diagnostic findings, parts required, and time estimates. They also record labor steps and quality checks performed. This digital trail builds accountability and simplifies communication. Customers receive timely updates and can see progress without guesswork. For fleet managers who coordinate many vehicles, that transparency streamlines logistics and reduces phone tag.

Real-time tracking software complements digital work orders by managing the flow of service calls and mobile units. When a mobile technician is dispatched, the system monitors progress and estimated arrival times. Shop coordinators can prioritize calls, reroute resources, and update customers instantly. Real-time visibility is particularly valuable during peak periods when several jobs compete for attention. The software helps balance workload and minimizes idle time for both trucks and technicians.

The mobile aspect of A & R’s service amplifies the value of these technologies. On-site repairs avoid towing and delay. Technologies that once existed only inside the shop now travel with the technician. Portable diagnostic interfaces, cloud-connected work order apps, and mobile parts catalogs allow a mechanic to perform complex repairs at a job site. That combination cuts total downtime and reduces the indirect costs associated with lost delivery windows and disrupted schedules.

Heavy-duty lifting equipment and specialized welding machines complete the technical toolkit. For structural repairs or component replacements, proper lifting and precise welding are non-negotiable. Advanced lifting rigs support large vehicles safely, while modern welding equipment offers better control and cleaner joins. A & R’s investment in heavy-duty tools ensures repairs meet safety standards and hold up under heavy loads. These tools also expand the scope of problems the team can address on-site, minimizing the need to move a damaged truck to a shop.

The most important link in this chain is the human one. Technology is powerful, but it is most effective when paired with skilled technicians. A & R invests in training so that mechanics understand both the mechanical and electronic systems they service. This dual competency is rare and valuable. Technicians interpret diagnostic data, make informed judgment calls, and adapt repair techniques to each vehicle. Their experience turns raw data into reliable fixes.

Data management is another area where technology pays off. The shop aggregates diagnostic logs, maintenance histories, and parts usage into a searchable system. This archive becomes an operational memory. When a recurring fault appears, technicians can pull up past incidents and learn what solutions worked. Fleet managers see patterns across their vehicles and can make fleet-level decisions. For example, if a model year shows a high incidence of a specific failure, the fleet can preemptively replace parts during planned downtime.

Inventory management benefits from digital integration too. Parts catalogs and stock systems connect to work orders. When a technician diagnoses a failed component, the system checks inventory in real-time. If a part is available, the repair proceeds without delay. If it is not, the system triggers procurement or suggests alternatives. This reduces repair turnaround times and avoids repeated trips caused by missing parts. For fleets operating under tight schedules, that reliability is crucial.

Customer experience improves markedly through these technologies. Clear, timely updates reduce uncertainty. When a manager knows estimated return-to-service times and sees diagnostic findings, they can adjust schedules and communicate with clients. The transparency builds trust. It also simplifies billing because work orders link diagnostics, parts, and labor into a single record. Customers receive a clear account of what was done and why. This documentation matters for compliance and for internal audits.

The financial benefits of these innovations are measurable. Faster diagnostics lower billable labor hours. Predictive maintenance reduces emergency repairs and their associated premiums. Better inventory control limits capital tied up in slow-moving parts. Mobile repair reduces towing costs and lost revenue from sidelined vehicles. Over time, these savings compound, improving fleet uptime and lowering cost per mile.

Technology also improves safety and compliance. Electronic records document inspections and repairs. That traceability supports regulatory requirements and helps in accident investigations. Precision tools and controlled welding reduce the chance of rework that could endanger drivers. Furthermore, data-driven maintenance often catches issues before they become safety hazards.

Integration across systems amplifies benefits. Digital work orders, diagnostic databases, inventory systems, and tracking software feed a unified view of operations. That integration reduces manual handoffs and the errors that come with them. It enables faster decision-making and simpler reporting. Managers can pull consolidated performance metrics to assess mean time between failures, average repair duration, and parts consumption trends.

Implementing these technologies requires discipline. Data must be captured consistently and entered promptly. Technicians must follow documented procedures to preserve the integrity of records. A & R fosters that discipline through standard operating procedures and regular training. The goal is to make technology an extension of steady workmanship, not a replacement for it.

The shop’s approach to innovation is deliberate. New tools are evaluated for practical impact rather than novelty. The team prioritizes solutions that reduce downtime, improve safety, or make repairs more accurate. This pragmatic stance prevents investment in marginal technologies and focuses resources on tools that produce clear returns. It also creates a predictable upgrade path as new capabilities emerge.

For smaller fleets, the benefits of A & R’s model are significant. Smaller operators often lack internal resources for complex diagnostics or heavy repairs. Mobile, technology-enabled service gives them access to capabilities previously reserved for large fleets. To explore strategies for managing fleets and maintenance budgets, see resources on optimizing fleet size and maintenance for small fleets. This perspective helps owners plan when to rely on mobile specialists and when to schedule shop-based overhauls.

Looking ahead, the role of technology will expand. Vehicles will deliver richer telemetry. Remote diagnostics will become more common. The challenge will be to translate incoming data into timely field actions. A & R’s investments in diagnostic tools, digital workflows, and skilled technicians position them well for that transition. Their model blends on-road responsiveness with shop-grade repair quality.

Ultimately, the value of these innovations rests on one simple outcome: reduced downtime. When a truck spends less time waiting for diagnosis, parts, or a capable technician, it earns revenue instead of incurring cost. The combination of mobile response, accurate diagnostics, and integrated workflows builds reliability. That reliability matters to drivers, dispatchers, and the customers they serve.

Technology is an amplifier of competence. At A & R Truck Repair Abbotsford, that amplification translates into practical advantages for local trucking businesses. Faster fixes, smarter maintenance planning, and clearer communication add up to fewer interruptions and steadier operations. For businesses that depend on on-time deliveries and safe equipment, those differences matter every day. For more detail about their services and capabilities, visit their official site: https://www.artruckrepair.com

Reading the Road: Assessing Customer Satisfaction for A & R Truck Repair in Abbotsford

When direct customer reviews are scarce, assessing a repair provider takes a pragmatic, evidence-based approach. A & R Mobile Truck Repair in Abbotsford presents a common scenario: clear claims about experienced technicians and a customer-first attitude, but no readily available star ratings or written testimonials. That absence does not have to leave fleet managers or owner-operators guessing. It calls for a structured method to evaluate service quality, one that combines observable signals, strategic questions, and targeted verification. This chapter outlines that method and explains how to translate limited public feedback into a reliable decision.

Start by focusing on operational signals that suggest consistent performance. A mobile repair service is judged first by availability and response time. In local trucking, downtime costs money every hour. Ask how quickly technicians can be dispatched within Abbotsford and surrounding routes. Request average response windows for common issues and peak-time expectations. A credible provider will give consistent timeframes instead of vague promises. Next, probe technician credentials. Experience matters, but so does documented training. Ask whether technicians hold up-to-date certifications for electrical systems, diesel engines, and on-road safety protocols. Confirmation of ongoing training programs or manufacturer-specific courses indicates a shop that invests in skill retention.

Transparency about parts, warranties, and billing practices is another cornerstone of satisfaction. A & R’s mobile model implies field repairs and parts sourcing on the go. Businesses should request the shop’s parts policy, warranty terms, and how emergency or expedited parts are billed. Clear policies reduce later disputes and shape perceptions of fairness. For example, a fair practice is to provide a written estimate and a parts versus labor breakdown before work begins. If a shop cannot provide this information, treat that as a red flag.

Communication quality often shapes reviews more than technical prowess. Drivers and operations managers recall whether the mechanic explained the fault, offered repair options, and described expected outcomes. When public reviews are missing, ask for real-world examples: recent calls resolved on the roadside, complex repairs completed at a client’s yard, or instances where mobile service prevented a lengthy tow. Request contactable references—preferably local fleets or long-term clients—so you can hear directly about responsiveness, workmanship, and follow-up care.

Reliability goes beyond a single repair job. Consider how a provider handles follow-up and accountability. After any repair, a conscientious shop will offer a limited warranty or guarantee, and they should describe what that covers. Confirm how warranty claims are handled in the field, and whether the company will respond to repeat failures during off-hours. A proactive approach to warranty service reduces long-term maintenance costs and fosters trust. Without online testimonials, warranty responsiveness and a clear escalation path become strong indicators of a service partner’s commitment to satisfaction.

Practical evidence also matters. Ask for before-and-after documentation from prior work. Photos of diagnostic readings, replaced components, and repair steps are useful. Mobile technicians who document repairs thoroughly usually apply similar care in each job. Insist on digital job sheets that list problems, actions taken, parts used, and labor time. These records help operations teams track recurring issues and allocate maintenance budgets more effectively.

Evaluate safety and compliance practices. A trustworthy mobile repair company will align with industry safety standards and local regulations. Inquire about insurance coverage, both for on-site work and potential property damage. Confirm whether technicians carry the necessary safety equipment and follow secure procedures when working on live roadways or in customer yards. Compliance is an invisible marker of professionalism and directly influences satisfaction when work affects driver safety and vehicle reliability.

Pricing fairness and clarity also feed into satisfaction. Even if competitive rates are not published, the provider should explain how labor is charged—flat call-out fees, hourly shop rates, or surcharge structures for after-hours and weekends. Request sample invoices and ask about markup on parts. Transparent pricing reduces the chance of billing disputes and supports positive word-of-mouth from fleet operators who need predictable maintenance costs.

When public reviews are absent, use local networks to collect informal feedback. Speak with dispatchers, other service providers, and nearby operations managers. Trucking communities in Abbotsford share practical reputations quickly; you can learn about a provider’s consistency through word-of-mouth. Trade associations and local carrier groups often maintain informal lists of trusted vendors. These conversations can reveal patterns that raw online reviews may not capture.

Encourage the shop to share case studies relevant to your fleet. If you run dry vans, ask for examples of electrical and trailer-related repairs. If you haul refrigerated loads, ask about experience with refrigeration units and their unique diagnostics. A provider that tailors its answers to your equipment demonstrates an operational fit rather than a one-size-fits-all approach. Specificity builds confidence in the technician’s ability to handle the problems your fleet faces regularly.

Customer satisfaction is also built through convenience features. A & R’s mobile model is inherently convenient. Dig deeper: does the company offer remote diagnostics, parts tracking, or integrated invoicing with fleet maintenance systems? Does it log repairs into a centralized record accessible to fleet managers? Technology that reduces administrative overhead and speeds repair decisions tends to increase satisfaction because it minimizes friction across the repair process.

If you still feel uncertain, use a staged engagement. Start with a low-risk job that tests response time, communication, and repair quality. Short emergency fixes or scheduled preventative checks are good trials. Treat the first few interactions as a short-term audit. Record response intervals, technician professionalism, and whether the repair held through normal operations. This cautious approach reduces exposure while providing direct experience you can use to form or solicit reviews.

For businesses that want to capture or amplify satisfaction signals, encourage clients and drivers to leave feedback after service. Ask for permission to share anonymized success stories and measurable outcomes, like reduced downtime hours or avoided tows. If a shop lacks public reviews, it may simply need a nudge to request feedback. A simple, consistent process for collecting and posting client feedback transforms private satisfaction into visible credibility.

From the provider perspective, responding to feedback—even in small volumes—matters. Prompt, constructive responses to praise and criticism demonstrate commitment. A shop that acknowledges a complaint and clearly outlines corrective steps shows accountability. That behavior often outweighs the absence of many reviews because it demonstrates a functioning feedback loop and a willingness to improve.

For fleets operating on tight budgets, satisfaction is closely tied to predictable maintenance costs. Link repair choices to internal budgeting and preventative maintenance practices. For guidance on creating and maintaining a financial buffer for unexpected repairs, consult this resource on budgeting for routine truck maintenance: Budgeting for routine truck maintenance. A realistic maintenance budget helps turn a single repair into an expected, manageable cost, reducing the emotional impact of a breakdown and improving perceived satisfaction with the service provider.

When a shop has few public reviews, documentation and proof points become the currency of trust. Ask for service agreements, proof of past fleet partnerships, and examples of how the provider reduced downtime. Validate those claims through references and local colleagues. The combination of thorough documentation, transparent policies, and demonstrable responsiveness creates a strong proxy for customer satisfaction.

Finally, take advantage of available online platforms to fill the visibility gap. Even when a provider’s profile lacks reviews, platforms such as MapQuest and business directories often contain operational details and contact information. For public review aggregation, check Google Reviews and Yelp for any mentions or ratings. If these platforms show no results, use the search link below to quickly locate available mentions and reviews:

https://www.google.com/search?q=A+%26+R+Mobile+Truck+Repair+Abbotsford+reviews

Taken together, these steps convert a weak online footprint into a clear evaluation. You will not rely on star ratings alone. Instead, you will assess operational reliability, technician competence, communication quality, warranty handling, and pricing transparency. These factors form a robust framework for judging satisfaction in the absence of a large number of online reviews. They help Abbotsford carriers and owner-operators select a mobile repair partner with confidence and manage the relationship so that satisfaction becomes visible, measurable, and repeatable.

Final thoughts

A & R Truck Repair Abbotsford is not just a service provider; they are a vital partner to the local trucking industry. Their on-site repair capabilities, combined with a focus on technological advancements and customer satisfaction, position them as an invaluable asset for fleet managers and trucking company owners. In understanding their operations and contributions, stakeholders can better appreciate the role A & R Truck Repair plays in fostering a thriving, efficient trucking environment in Abbotsford. By minimizing vehicle downtime through their quick response and expert services, A & R Truck Repair enables its clients to operate confidently and effectively in the ever-demanding trucking sector.