The repo truck, a vital asset in vehicle recovery, plays a pivotal role for fleet managers, trucking company owners, and logistics providers. Understanding its purpose and functionality helps optimize processes surrounding vehicle repossession. With insights into the types of repo trucks, the repossession process, and the legal implications, stakeholders can make informed decisions that enhance operational efficiency and compliance. Each chapter will dissect a critical aspect of repo trucks, empowering industry leaders to effectively navigate challenges associated with vehicle recovery and disposal.

Purpose, Power, and the Repossession Route: Understanding the Repo Truck’s Role

A repo truck is more than a specialized vehicle on the edge of legality; it is a carefully engineered tool within a tightly governed process. At its core, the term points to a tow truck used specifically to recover collateral after a borrower defaults on an auto loan. It is not a mystic machine, nor a single model of vehicle, but a standard towing platform equipped and deployed to move a repossessed car from its location to a storage facility or an auction site. The primary aim is to reclaim value for the lien holder while guiding the borrower’s obligation through the proper channels of the financial system. In the larger arc of automotive finance, the repo truck represents both enforcement and efficiency: a steady hand that applies legal remedy while aiming to minimize damage to property and risk to the people involved. It is a liminal instrument, existing at the intersection of law, logistics, and finance, where speed, precision, and compliance must all align to protect the interests of creditors and, ideally, the integrity of the overall lending environment.

The function of a repo truck begins long before the vehicle is strapped down and hauled away. Its very effectiveness rests on a clear purpose: to transport repossessed vehicles from the borrower’s location—whether a driveway, a parking lot, or a street corner—to a facility where they can be stored, inspected, and prepared for auction. This is not a casual operation; it embodies a disciplined sequence governed by contracts, statutes, and local regulations. Lenders rely on the ability to recover collateral in a timely fashion, preserving the vehicle’s potential value as collateral and reducing the lender’s overall exposure. For a repossession professional, the work is less about drama and more about procedural rigor: locating the vehicle, confirming ownership and the legal right to reclaim, ensuring access where permitted, and then applying the appropriate loading technique with care to avoid unnecessary damage. The story of a repo truck, in short, is a practical account of risk management in motion, where every maneuver balances speed with safety and legality with efficiency.

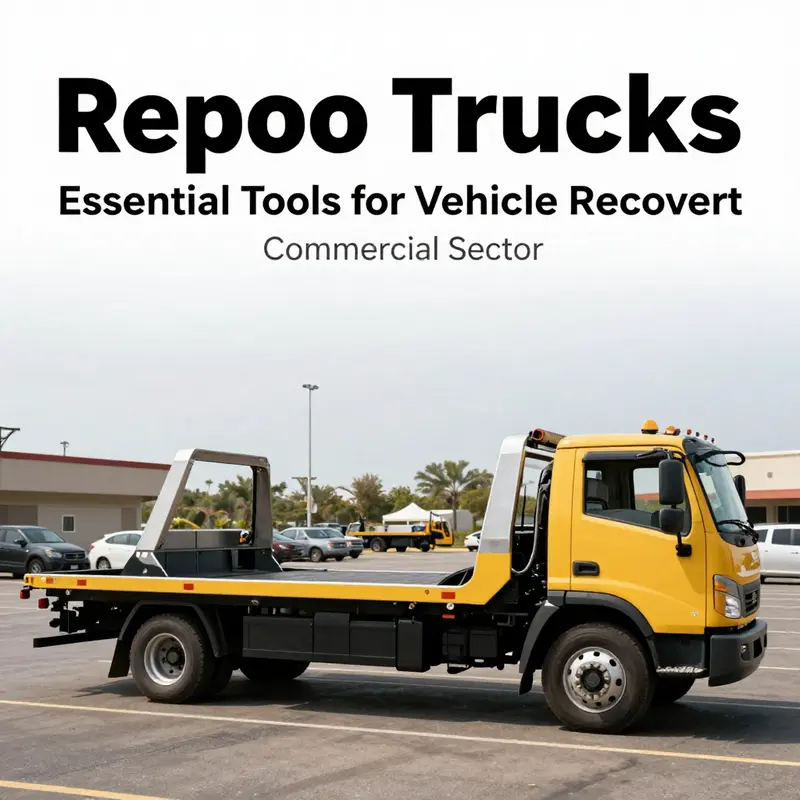

Two broad configurations dominate repossession operations because they address different scenarios and preservation goals. A flatbed tow truck offers a full-body lift onto a rigid platform. This method minimizes tire wear and suspension stress and is generally favored when the vehicle’s condition is uncertain, when the vehicle has been disabled, or when the reselling value of the car could be preserved best by avoiding transfer onto wheels. A wheel-lift system, by contrast, situates lifting mechanisms under the wheels themselves, enabling the vehicle to be towed with fewer surface-area constraints and often at a lower cost. Wheel-lift setups can be faster to deploy and are well suited for situations where the vehicle can still be moved under its own power or when access to the undercarriage is limited. Each method embodies trade-offs: flatbeds emphasize protection and value preservation, while wheel-lift configurations emphasize agility and economy. In practice, a repossession operation will choose the configuration that aligns with the vehicle’s condition, the location, and the lender’s risk tolerance, all while ensuring a lawful process that safeguarding owners’ belongings and minimizing unintended damage.

The actual repossession sequence commonly unfolds in a way that underscores the responsible posture of the profession. A licensed and trained repossession agent locates the vehicle through accurate records, often cross-checking with the lender’s lien information and, when needed, seeking court or administrative authorization to pursue access. The agent then approaches the site with a plan that respects residents’ and businesses’ rights and minimizes disruption. If access is permitted by law, the vehicle is secured with secure tie-downs and, depending on the vehicle’s state, may be restrained with chains or webbing that distribute force evenly to avoid damage during transport. Loading the car onto the chosen carrier is a moment that requires steady hands and a practiced eye: the wheels or the chassis are stabilized, the loading angle is controlled, and the vehicle is secured against shifting during transit. The actual tow is then a measured roll through permitted routes to the storage yard or auction site, accompanied by routine checks to confirm that the vehicle’s identifying information remains intact and that ownership labels are preserved for the handoff to the next stage in the process.

A repossession operation depends on equipment that blends safety with reliability. The loading gear—hydraulic lifts, winches, and robust tie-down systems—must tolerate a range of scenarios, from damaged vehicles to tight parking spaces. The hydraulic lift provides a controlled, level lift onto a flatbed, keeping the vehicle aligned and minimizing bounce risks during transport. Winches, when used, offer controlled pulling that helps the team secure a disabled or immobilized car without slippage. The tie-downs must be strong enough to secure a variety of weights and configurations while preventing movement that could create hazards on public roads. The technician’s proficiency with this equipment matters as much as the equipment itself; the human factor—attention to detail, situational awareness, and careful communication—ensures that every tie-down bite and every strap tension is appropriate for the vehicle’s weight and balance. This combination of hardware and skill supports a transport that maintains the vehicle’s condition as much as possible and keeps everyone involved out of harm’s way.

The literature on repossession emphasizes speed because time is a critical factor in protecting collateral. A lender’s risk increases with every hour a vehicle remains in the borrower’s possession and with every moment a recovery effort stalls. Yet speed cannot come at the expense of legality or safety. A repo truck operator must navigate a landscape of statutes, municipal codes, and contractual terms that govern when and how a vehicle can be seized, how access to a premises can be obtained, and what the proper channels are for handling personal belongings left inside the car. In many jurisdictions, the process requires notice and sometimes a lawful warrant or a court order to avoid unlawful entry. Even when access is granted or anticipated, professionals proceed with the principle of minimal intrusion, balancing the need to secure the vehicle with respect for the borrower’s property and the surrounding community. This careful balancing act reinforces the ethical dimension of repossession work, reminding the industry that a repo truck operates within the rule of law, not outside it.

Every repossession experience carries potential complications that test preparation as much as courage. Access issues can arise when a car is parked in a locked garage or when the keys are not readily available, especially in cases of high security or keyless entry. In such situations, agents may rely on documented processes to demonstrate the legal right to reclaim property or to coordinate with property managers and law enforcement if required. Disputes over personal items inside a repossessed vehicle add another layer of complexity. It is not uncommon for items of sentimental or monetary value to be left behind or misplaced during the transport, leading to post-repossession disagreements. The professional response to these issues is procedural rigor and transparent documentation: inventorying items at the point of loading, recording notable belongings, and establishing clear channels for post-recovery item handling. These practices reflect a broader commitment to fairness and to the integrity of the repossession workflow, ensuring that the process remains accountable from the moment the vehicle is located to the moment it reaches the storage or auction facility.

The broader significance of the repo truck within the financing ecosystem merits reflection. A repossession vehicle is not a luxury instrument; it is a practical tool that enables lenders to reduce losses by recovering collateral efficiently. When a car is moved promptly and safely, its resale value is preserved to the greatest extent possible, enabling the lien holder to recoup a portion of the outstanding debt and to reallocate capital to new lending opportunities. In households and communities, the existence of this process can also shape how borrowers evaluate the consequences of missed payments, reinforcing the idea that financing carries obligations as well as benefits. Yet the story of the repo truck also invites a careful examination of ethics and stewardship. The operation should minimize damage, protect personal belongings, and pursue recovery in ways that respect the dignity of the people involved. The vehicle is not merely cargo in transit; it is a piece of property with rights and a potential for future use, especially when the record-keeping is accurate and the handling is careful.

The professional practice surrounding repo trucks is evolving with technology and regulation. Licensed agents receive training that covers not only the mechanics of towing and loading but also the legal frameworks that govern repossession. Ongoing education about safe operation, safe driving, and the latest compliance requirements helps maintain high standards across the industry. Some fleets are increasingly mindful of the ecological footprint of their operations, seeking ways to optimize routes and reduce idle time, thereby lowering emissions while preserving turnaround times. This broader awareness intersects with fleet management philosophies that emphasize efficiency, safety, and accountability. For operators who view repossession as part of a licensed, regulated process rather than a raw exercise of power, the repo truck becomes a instrument of constitutional and contractual correctness, a practical agent that translates financial agreement into enforceable action while maintaining the highest standards of care for property and people alike.

For readers curious about how repossession fleets fit into larger fleet-management and maintenance discussions, there is value in examining the balance between recovery speed and ongoing upkeep. Fleet managers who oversee repossession operations must contend with scheduling, maintenance, insurance, and regulatory compliance as part of a unified system. The practical takeaway is that the repo truck is a specialized tool within a broader set of practices designed to ensure reliability, accountability, and ethical conduct across the lifecycle of a vehicle’s collateral status. Those who manage or operate such fleets often explore the same questions that any heavy-duty operation faces: How do you maintain uptime while controlling risk? How do you balance rapid response with the need to minimize wear and tear on expensive equipment? How do you document every step of the process so that outcomes are transparent and defensible? Answers to these questions emerge from a culture that treats repossession as a professional service—one that respects legal boundaries, protects personal belongings, and supports creditors in a way that upholds the integrity of the system.

In the end, a repo truck embodies a specific, necessary function within the economy of credit. It translates a contractual consequence into a tangible action, enabling the lender to secure collateral in a manner that prioritizes safety, legality, and value preservation. It is a machine yoked not only to metal and hydraulics but to the careful stewardship of the people who drive it and the procedures that guide its operation. The result is a transportation solution that safeguards assets, supports financial accountability, and, when executed well, maintains public trust in the repossession process. As with any profession that sits at the crossroads of law and logistics, the repo truck reminds us that systems built on credit depend on precision, discipline, and humane handling—every time a wheel rolls toward a storage lot or auction block. For those who seek a deeper dive into how fleet management intersects with maintenance and efficiency, optimizing-fleet-size-maintenance-small-fleets offers a framework for thinking about how to balance demand with capacity in practical, scalable ways.

null

null

Tow Lines and Legal Lines: The Anatomy of Vehicle Repossession Through Repo Trucks

When the first light of dawn cuts across a quiet street, a tow truck may already be in position, its presence a quiet reminder of a promise made, kept, or broken. In the world of auto lending, a repo truck is not a flashy tool or a brand-new machine; it is the working backbone of a process that sits at the intersection of contract law, finance, and everyday consequences. The vehicle pulled from a driveway or a parking lot is more than metal and tires. It is collateral secured against a loan, a tangible reminder of risk both lenders and borrowers shoulder. The repo truck, therefore, embodies a careful balance of legality, logistics, and responsibility. It moves within boundaries that are as much about the law as they are about industry practice. And because every repossession is, at its core, a negotiation of risk and remedy, the truck’s role is both practical and symbolic—an instrument through which a lender can recover value while attempting to respect the borrower’s rights and the surrounding community’s safety.

Within this framework, repo trucks are the practical engines of a broader process. They perform a precise service: retrieve a vehicle that has defaulted on its loan and transport it to a secure facility or an auction site. The mechanics of how that happens hinge on two standard categories of tow equipment—flatbeds and wheel-lift units—each with its own implications for safety, efficiency, and cost. A flatbed tow truck carries the entire vehicle on a level platform, ensuring that the car’s tires, suspension, and body avoid contact with the ground. This is the more cautious option, favored when the vehicle’s condition matters for resale value or when the lender seeks to minimize the risk of additional damage during transport. A wheel-lift tow truck, by contrast, uses hydraulic arms to lift one end of the car and move it on a pivot, enabling quicker pickups and shorter tow times. It is more economical and adaptable for urban or congested environments, yet it can place a bit more stress on tires and suspension and may be less forgiving if a vehicle sits in rough condition.

The actual repossession is a carefully choreographed operation conducted by a licensed repossession agent—the so-called repo man—who locates the vehicle, assesses the location, and proceeds under a framework of state and local laws. Unlike a routine tow, a repossession demands a clear legal basis and a documented process. In many cases, the borrower’s default status has already been established through a lender’s review of account activity, often triggered by missed payments or a breach of contract. The agent then verifies the location, secures permission for access if required, and proceeds with the tow. The act of securing the vehicle is done with restraint and care: chains or straps are fastened to the appropriate points, and the vehicle is then guided onto the tow truck for transport. The aim is to minimize further damage, to respect lawful boundaries, and to remove the vehicle from private space with the least disruption possible.

But the path from default status to a loaded tow is not always linear. Repossession can unfold in consensual or non-consensual forms, and the distinction matters for the borrower’s rights as well as for the agent’s approach. In consensual repossession, the owner agrees, in practical terms, to allow the tow and to cede possession in exchange for resolution of the debt or through a negotiated settlement. The towing process in this case is typically direct, with the agent attaching to the vehicle’s frame or hitch and securing it for transport in a manner that minimizes damage and loss of vehicle value. In non-consensual repossession, the agent operates under a stricter legal framework. The car is seized without the owner’s explicit consent, but only in accordance with state statutes that govern notice, access, and the manner in which a vehicle may be removed. In such scenarios, entry into private property is not a given; private spaces like closed garages or locked driveways are generally off-limits to repossession agents unless explicit permission is granted or a lawful exception applies. Yet, if the vehicle is plainly visible in a public space—on a street, in a public lot—the repo action may proceed under established legal guidelines. The distinction between consensual and non-consensual repossession underscores a broader principle: the repossession pipeline is designed to respect consumer rights while enabling lenders to recover collateral.

The landscape of practice continues to evolve with technology and regulation. Traditional towing remains the backbone of repossession for its reliability and scale. It is well-suited to rural recoveries, vehicles caught in difficult terrain, or cases where the condition of the car must be preserved for resale. Yet digital tracking and GPS-enabled fleet management have begun to change the pace and visibility of repossession work. Real-time location data helps lenders, agents, and even courts verify progress, anticipate obstacles, and maintain an auditable trail of activity. This transparency supports accountability for the repo process, which, in a landscape marked by high stakes, offers a measure of reassurance to all parties—lenders, borrowers, and the public alike.

The consequences surrounding repossession extend beyond the moment of tow. A repossessed vehicle re-enters the lending cycle as collateral in a sales process designed to recover unpaid balances for the lender. The borrower’s credit standing can suffer, and the remaining debt may still be owed depending on the status of the loan and the sales outcome. The emotional dimension is real as well; even when the legal framework is followed, the experience can be disruptive and stressful for the borrower and their family. These dimensions—financial, legal, emotional—interlock with the operational realities of repossession. For lenders, progress must be measured not just by recovered value but by how the process aligns with consumer protections and the law. For borrowers, understanding rights and options—such as opportunities for reinstatement, payoff plans, or negotiated settlements—can influence outcomes and reduce the sense of loss that accompanies repossession.

Within this larger context, the repo truck emerges as a practical but often overlooked protagonist. It is not a specialized vehicle with a mystique; it is a standard tow truck performing a highly specialized service. Its design choices—whether to operate on a flatbed or to employ wheel-lift technology—reflect a balance between asset protection and operational efficiency. The equipment must be reliable in varied conditions: on icy driveways, in muddy streets, at the edge of a busy parking lot, or in a quiet cul-de-sac where space is tight. The operator’s skill set—trained to assess risk, to communicate clearly with property owners when possible, and to apply the most cautious technique—marks the difference between a straightforward recovery and a mishap that could generate liability. Even the best-trained agents must navigate the gray areas of private property access, the limits of force, and the requirements of local law. In other words, the repo truck operates within a legal and moral ecosystem as much as within a mechanical one.

As a chapter in a broader exploration of repossession, this discussion of the repo truck invites readers to see the craft behind the action. It is a reminder that the process is not simply about a car being taken away; it is a disciplined procedure designed to protect value, maintain safety, and respect legal boundaries. The equipment, the procedures, and the people involved form a coordinated system that can adapt to different contexts—urban or rural, consensual or non-consensual, simple or complex. The repo truck thus serves as a vehicle for understanding how finance and daily life intersect in concrete ways. The vehicle’s journey—from a loan default to a waiting auction, from a driveway to a storage lot—becomes a narrative about risk management, responsibility, and the human implications of debt.

To anchor this discussion in practical realities, consider the maintenance and readiness that keep repossession fleets functional. A fleet that can respond quickly to a default event must balance ongoing upkeep with the unpredictable demands of the road. Regular maintenance, inspections, and timely repairs are essential to prevent delays and to minimize downtime when the next assignment comes through. For readers exploring operations and resilience in heavy-vehicle contexts, a closer look at maintenance budgeting can be illuminating. See Budgeting for Routine Truck Maintenance for strategies on sustaining a fleet without sacrificing readiness or safety. Such planning is not a luxury; it is a core discipline that ensures repossession work proceeds with minimal disruption and maximum reliability. By keeping the hardware in good shape, a repossession operation preserves value and protects against avoidable setbacks that could affect both lender confidence and borrower outcomes.

From a broader perspective, the repossession process—powered by repo trucks and guided by legal and regulatory constraints—illustrates how society organizes risk and remedial action. The rules that govern access, the obligations to avoid unneeded damage, and the emphasis on non-coercive methods where possible all reflect a system that seeks balance. The result is a sequence of events that, while rarely celebrated, remains essential to the financial ecosystem. It provides lenders with a mechanism to recover collateral and borrowers with a clear framework within which debts can be addressed, renegotiated, or resolved. The car moves, the law guides, and the city inherits a practical problem-solving approach that keeps the financial chain intact, even as it tests the limits of human experience and corporate responsibility.

For those who want a concise reference on consumer protections that surround this process, the Consumer Financial Protection Bureau maintains authoritative guidance and updates on repossession practices, including rights, notices, and remedies available to borrowers. This resource helps contextualize the mechanics described above within the larger framework of consumer finance and protection. Understanding these boundaries is as important as understanding the mechanics of the tow itself. The discussion here is meant to illuminate how a routine act of towing, performed correctly, sits within a system designed to minimize harm while preserving the lender’s ability to recover value. In that sense, the repo truck is more than a tool for moving a vehicle; it is a conduit through which the complexities of debt, law, and daily life are navigated with care and accountability.

External link for consumer protections and detailed guidance: https://www.consumerfinance.gov/owning-a-home/repossessions/

The Lawful Tow: Legal Boundaries and Responsibilities in Vehicle Repossession

A repo truck is more than a specialized piece of equipment. It is the mechanical embodiment of a lender’s right to recover collateral when a borrower defaults. The legal status of this act rests on clear, often jurisdictionally defined rules that govern how, where, and when a repossession may occur. The vehicle used to perform the repossession—the repo truck—must operate within a framework that respects contract rights, property boundaries, and the public order. In practice, this means that a repossession action is not simply about getting a car from point A to point B; it is a carefully timed, documented, and restrained application of force, limited to what the law allows and what the contract permits. The result is a process that, when done correctly, upholds the creditor’s security interest while minimizing harm to the debtor and the property involved. The tension between efficient debt collection and individual rights makes the legal landscape around repo trucks both nuanced and essential to understand for anyone involved in the practice, from lenders and repossession agents to everyday readers trying to grasp how debt enforcement works in real life.

At the core of any repossession is the legal right to recover collateral. A lien or other security interest must exist, and the creditor or their agent must act under the authority granted by that instrument. This authority is not a license to act violently or coercively; it is a mandate to retrieve the vehicle in a manner that is legally permissible. The most fundamental constraint is the prohibition on breach of the peace. In practical terms, this means a repossession agent cannot threaten or use violence, cannot forcibly enter a locked garage without lawful authority, and cannot intimidate a debtor to surrender the vehicle. When a repo truck is involved, the line between permissible action and unlawful pressure is tested by how the operation is executed, how access is gained, and how the vehicle is removed. A tow may proceed with consent implied by the debtor’s defaulted contract, but it cannot cross into intimidation, harassment, or unlawful entry. This is why many agencies emphasize procedural discipline: to document the chain of authority, the condition of the vehicle, and the exact sequence of events that lead to removal.

The mechanics of the process illuminate why the choice of tow equipment can become a legal question in itself. There are two main types of tow trucks commonly used in repossession: flatbeds and wheel-lift units. A flatbed tow truck elevates the entire vehicle onto a platform, which protects tires and suspension and minimizes the risk of additional damage during transport. A wheel-lift unit, by contrast, engages wheels with a lifting mechanism and can be more cost-effective but may introduce more wear and potential damage if used inappropriately. From a legal perspective, the selection of equipment intersects with duties of care and the standard of reasonableness expected in repossession practice. If a vehicle is damaged during repossession due to improper handling, questions arise about whether the agent acted within the bounds of the contract and whether the equipment was appropriate for the job. Conversely, a vehicle that suffers no additional harm may reflect a more cautious, methodical approach that reduces liability for both the lender and the repossession company. These concerns are rarely abstract; they become concrete issues if there is a dispute over the condition of the vehicle at the moment it is repossessed or when it arrives at a storage site or auction yard.

Beyond the mechanics, the legal framework scrutinizes the conduct of the agent during the locating, accessing, and towing stages. A repossession agent must be licensed and trained, with a solid understanding of consent, property rights, and applicable statutes. The agent’s role is to verify the debtor’s default against the contract, confirm the vehicle’s identity, and proceed with restraint that aligns with the law. Any attempt to gain entry without lawful authority can expose the operation to civil liability and potential criminal charges. The risk of criminal exposure rises when the agent uses threats, physically blocks access, or employs coercive tactics to compel surrender. In some jurisdictions, such conduct could also be described as extortion, a serious offense that underscores why professional training and a clear procedural doctrine matter so much in repossession work. These legal sensitivities drive the importance of meticulous documentation: the initial notice of default, proof of the lien, the authorization to repossess, and the precise steps followed during the tow. Each element supports a plausible chain of custody for the vehicle and a defensible posture if the transaction is later challenged in court.

The private-property dimension of repossession adds another layer of complexity. On private driveways, in locked garages, or within gated communities, the question becomes whether the repossession can occur without trespass and without violating property rights. In many cases, a lender or an authorized agent may proceed if they have proper documentation and do not breach the peace. Yet the mere physical presence of a repo truck in a private setting can create a flashpoint for civil liability if the debtor or the property owner perceives intimidation or coercion. This is why the jurisprudence around repossession emphasizes restraint and respect for boundaries. Agents are trained to avoid forcing entry, to respect posted restrictions when lawful, and to document any interactions with property managers or residents who may be present during the tow. When disputes arise, the critical questions focus on whether the property was accessible, whether the agent had legitimate authority to act, and whether the pursuit or securing of the vehicle created an unreasonable disturbance or used unlawful means to effect possession.

Regulatory oversight also shapes how repo trucks operate. In many places, state departments of motor vehicles and consumer protection agencies issue guidelines that specify permissible practices for repossession. These guidelines often require that agencies maintain a clear, auditable record of every repossession action, ensure the vehicle is towed in a manner that prevents unnecessary damage, and avoid aggressive tactics that could be construed as harassment. Regulators may impose penalties for practices deemed unfair or deceptive, and they may intervene if patterns of conduct suggest systemic abuse, coercion, or a deliberate attempt to frustrate consumer rights. Such oversight serves a dual purpose: it protects consumers from overzealous collection tactics and it provides lenders with a reliable, lawful path to recover collateral. The balance is delicate. Enforcement actions that swing too heavily toward consumer protection can hinder legitimate debt recovery, while lax oversight can invite abuse. The interplay among contract law, property rights, and administrative regulation creates a legal ecology in which every repo truck operation is weighed against a spectrum of permissible behavior and corresponding remedies.

From the lender’s perspective, the legal architecture surrounding repo trucks also centers on risk management and reliability. Documentation matters as much as horsepower. A lender will want a robust record showing that the vehicle was located, that proper notices were provided, and that the tow was executed in a manner consistent with the contract and the relevant statutes. The choice of whether to pursue a private-property repossession or to effect recovery on public property, for instance, often hinges on risk calculations and the anticipated likelihood of dispute. The goal is not reckless action but predictable, legally defensible conduct that can withstand legal scrutiny if the matter ends up in court. This is why many repossession firms emphasize compliance training, incident reporting, and ongoing audits of procedures. In turn, lenders benefit from greater confidence that their collateral can be recovered with minimal additional liability and with a clear chain of accountability should questions arise later.

For debtors, awareness of these boundaries can help frame responses if a repossession occurs or is imminent. Debtors retain certain rights, including the right to be informed about the terms of the loan and the conditions under which the creditor may reclaim the vehicle. They also have avenues to challenge the process if the repossession appears unlawful or if the agent breaches the peace, trespasses without proper authority, or engages in coercive behavior. Knowing that such remedies exist can influence both the debtor’s behavior and the lender’s approach, encouraging a process that prioritizes legality and restraint over expediency and intimidation. The practical takeaway for consumers is to seek clarity about the nature of the lien, the grounds for repossession, and the exact steps the agent intends to take. If questions arise, it is often advisable to consult a legal professional who can assess whether the procedure aligns with the contract terms and the governing statutes.

For practitioners in the field, one takeaway loops back to the equipment and its maintenance. A well-maintained repo truck reduces the risk of mechanical failure that could complicate a difficult removal, minimize potential damage to the recovered vehicle, and support a smoother operation overall. Operators should not overlook the value of routine upkeep as part of compliance and risk management. In fact, reliable fleet operations intersect with legal risk management in important ways. A breakdown at a critical moment can prolong an already tense process and invite questions about timeliness and competence. That is why the prudent approach includes proactive maintenance planning and systematic reviews of each tow operation. See the discussion on budgeting for routine truck maintenance for a practical view on how maintenance philosophy translates into legal and operational safeguards.

Ultimately, the legal implications of using a repo truck hinge on intent, process, and restraint. The intent must be to recover the collateral within the framework of the contract and the law. The process must be conducted with due regard for property rights, public safety, and the safety of all parties involved. The restraint is the rule that no one should feel pressured, threatened, or coerced into surrendering a vehicle. When these elements align, the repossession can proceed in a way that is legally defensible and procedurally sound, reducing the likelihood of later disputes and ensuring that the lender’s right to recover is exercised without overstepping boundaries. The law does not deny debt collection; it simply channels it through standards designed to protect both property interests and individual rights. For further context on the legal rules governing repossession on private property, see Can a Tow Truck Repo Your Car on Private Property, which outlines the exceptions and protections for consumers in various jurisdictions.

External resources: For additional guidance on the legal framework of tow-based repossession, see https://www.legalzoom.com/articles/can-a-tow-truck-repo-your-car-on-private-property

Final thoughts

In summary, repo trucks are indispensable tools in the vehicle recovery ecosystem, serving the needs of fleet managers, trucking company owners, and logistics providers. Their distinct types—flatbed and wheel-lift—cater to different operational requirements, while understanding the repossession process and its legal implications ensures compliant and efficient practices. By integrating knowledge of repo trucks into your operational strategy, you can streamline recovery operations while maintaining responsibility and adherence to legal standards.